Satellite Locations or Consolidation: Review the Details

When business starts to increase, it’s time to dig in your heels a little deeper to turn your firm’s revenue growth into an upward trend — rather than just a good month. Buying or renting a larger facility can help.

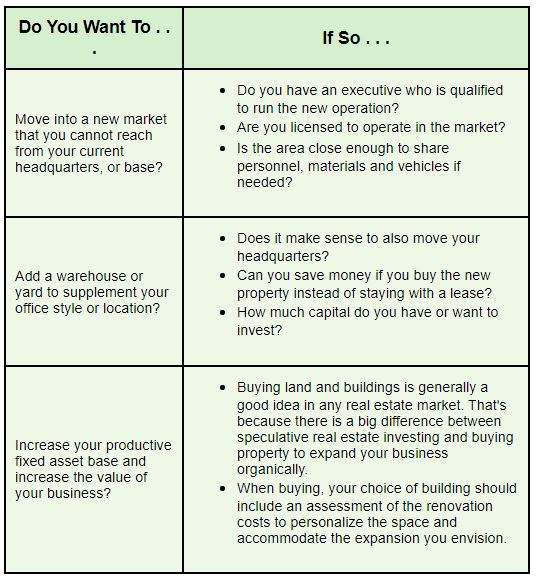

There are certain key factors to consider when making a decision to expand or consolidate your physical plant operations base. Here are some questions to consider before you start allocating dollars to the plan:

Financial Considerations

Investment in productive fixed assets is the most profitable way to do business. You don’t need to be sold on the value of building and owning property. In fact, leasing your workspace doesn’t really put you in charge of the building or land, because when the needs of your firm change you might find yourself locked into a long term lease that doesn’t satisfy your work environment needs.

In the building purchase-lease decision, amount of money down and planned length of stay are the two most important considerations, if your creditworthiness is not a problem. For instance, if the new location is to be considered permanent — if it will be sold or passed on with your company when you retire — then coming up with a cash down payment on a building purchase may not be as hard as you think.

On the other hand, if you see your firm potentially outgrowing the new facility, or if you have plans to liquidate the business when you retire, then leasing a plant offers a low-cash way to get right into a more productive and profitable work environment.

Hire experts to move your firm’s offices, equipment and/ or materials for you. Your workers will need to keep performing their jobs during the move. The moving part of consolidating facilities can be a significant cost, so plan for it. Get moving quotes and build those amounts into your evolving capital budget for the new office, warehouse or yard space before you sign any contracts.

Consult with your accountant or advisor on ways to accumulate the cash quickly to put down on a large fixed asset purchase. Keep in mind, the land and buildings make great collateral for loans and financing later! The money you put down will work for you.

Current Contractual Conditions

If your firm is currently leasing your company’s workspace, then a good read of the lease can reveal:

1. An upcoming renewal date or shorter duration of the lease;

2. A subleasing arrangement possibility; or

3. A buyout or early cancellation provision.

If you are hesitating to expand your business because you feel like you’re stuck in your current lease, think again. Your lease may contain provisions that let you sublet the space. If rental market conditions are favorable, you may even make a profit on the sublet. But if you become a landlord you will have to collect rent and try to keep the unit occupied.

If the lease does not allow you to sublease, there may be another way. Some landlords let tenants out of their lease if they find another tenant to take over the lease. Even if there is nothing about this mentioned in the lease, your landlord may still accept this “friendly arrangement.”

In some cases, landlords will accept less per month from a new tenant and let you out of the lease if it means avoiding the costs and time of going to court. Your landlord may accept any reasonable buyout offer.

Logistics: Will Expanding Enhance or Diminish Synergies?

If your firm is moving to expand into new markets, then synergy is certainly working for you because the new revenues brought in by the new office, warehouse or yard location will offset the additional costs.

But if your firm is expanding just to increase square footage or to accommodate more personnel — and new markets are not involved — be careful. Buying or renting one larger warehouse-office-yard combination to consolidate your firm’s facilities into one location might be a better choice.

Consult with your accountant about any plans you have to expand or consolidate.

This article appeared in Walz Group’s December 12, 2022 issue of The Bottom Line e-newsletter, produced by Checkpoint Marketing.