Are You Ready for Possible State Minimum Wage Increases?

In today’s tight labor market, many employers have been raising wages substantially to maintain operations. That’s most evident in the leisure and hospitality sector, where average hourly wages rose 12% for the year ending October 2021.

For many organizations, getting by with paying minimum wage is generally a distant memory. That’s particularly true where the state’s minimum wage is the same rate — $7.25 — as the federal rate that’s been in place since 2009. In other states with minimums as high as double the federal rate, it can be a different story. Even a small minimum wage increase can have significant financial consequences for a business or not-for-profit organization.

State Variations

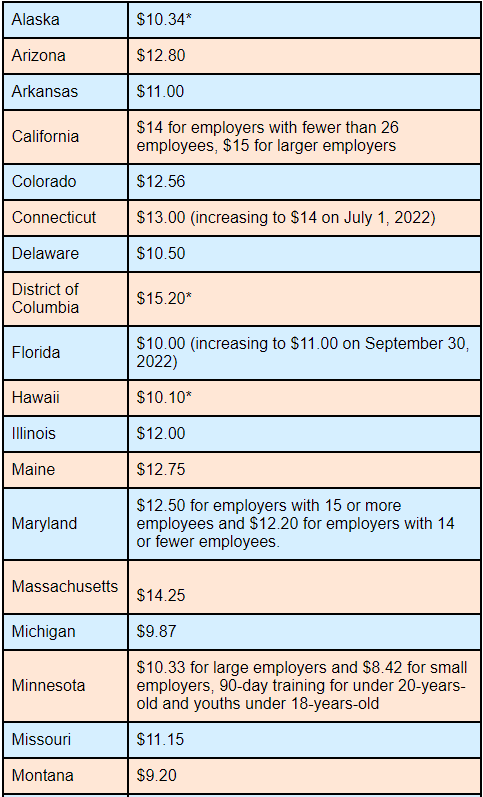

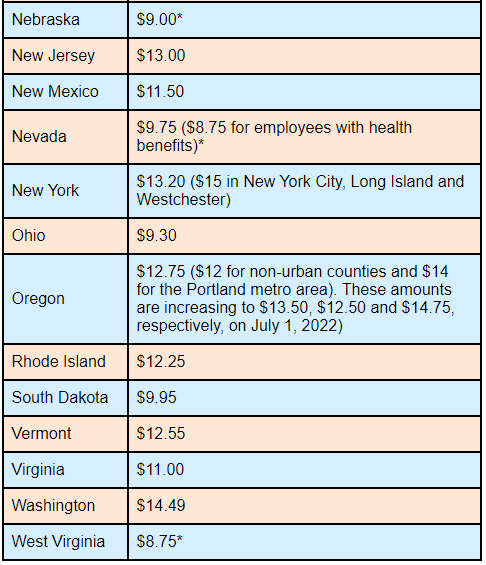

Minimum wage rates vary from state to state. (See “State Minimum Wage Rates for 2022 for Non-Tipped Employees,” below, for a rundown on minimum wage rates in the 30 states whose rates exceed the federal $7.25 minimum for 2022.) Many states will increase their minimum wage rates starting on January 1, 2022.

When reviewing state rates, be sure to get the details, including different rates for tipped employees, from your state’s labor department. Also, keep in mind that many localities have higher minimum wages than the states they’re in. For example, starting in January 2022, the minimum wage in Maryland will be $12.50 per hour for employers with 15 or more employers and $12.20 per hour for employers with 14 or fewer employees. But it will be as high as $15 per hour for large employers in Maryland’s expensive Montgomery County. Also, some states set lower minimums for employers below a specified size threshold. For example, in Montgomery County, Maryland, the general minimum rate is $14 for employers with 11 to 50 employees, and $13.50 for employers with 10 or fewer workers.

California has many localities with higher minimum wage rates than the 2022 state rate of $14 for employers with fewer than 26 employees and $15 for larger employers. For example, in 2022, Palo Alto’s minimum per-hour wage will be $16.45, Mountain View’s will be $17.10, Redwood City’s will be $16.20, and Santa Clara’s will be $16.40. (These are just a handful of the California local rates that are higher than the state rate.)

Meanwhile, Seattle will have one of the highest minimum wage rates in the country in 2022. The state minimum wage will be $14.49 per hour. But for large Seattle employers (with 501 or more employees), it will increase to $17.27 per hour. For small Seattle employers (with 500 or fewer employees), the 2022 minimum wage will be $15.75 per hour for employers who pay $1.52 per hour toward the employee’s medical benefits and/or for workers who earn at least $1.52 per hour in tips.

Cost of Living Considerations

In many states, minimum wage levels are determined with consideration to what a local “living wage” might be. For those that do, higher inflation rates may give employers in those states a preview of future minimum wage levels.

For such employers, tools exist to help them get a handle on the question of what it takes for people to achieve a basic standard of living in their area. One is the “living wage calculator” created in 2004 by Amy Glasmeier, Professor of Economic Geography at the Massachusetts Institute of Technology. According to MIT, the tool is “a market-based approach that draws upon geographically specific expenditure data related to a family’s likely minimum food, childcare, health insurance, housing, transportation, and other basic necessities’ cost.”

Comparisons between cities reveal some stark, if not surprising, contrasts. For example, the tool suggests that a living hourly wage for a single adult in San Francisco is $28, but it’s only $13.46 in Topeka, Kansas.

Jump for Federal Contractors

The minimum wage rate for employees working under federal government contracts has been moving up. That’s because those changes can be made by the executive branch without the necessity of Congressional approval. There are roughly 3.7 million federal contractors, according to one estimate.

Specifically, employees performing work on or in connection with covered contracts must be paid at least $11.25 per hour as of January 1, 2022. That represents a 2.7% increase over the prior $10.95 level. However, the hourly rate will be substantially higher — $15 — for federal contracts entered into on or after January 30, 2022, or extended pursuant to a contract option, according to the U.S. Department of Labor (DOL).

The DOL recently issued three Fact Sheets that pertain to federal contractor minimum wage issues under related Executive Orders. They are: Fact Sheet 39J – Minimum Wages for Workers with Disabilities; Fact Sheet 83A – Establishing a Minimum Wage for Contractors; and Fact Sheet 83B – Raising the Minimum Wage for Contractors.

Analyze All Pieces of the Puzzle

Even without regard to labor market conditions, the recent uptick in inflation may cause some employers to think beyond legally required minimum wages. In November, the Consumer Price Index was 6.8% higher than November 2020, with key drivers being gasoline, food and used cars.

Understanding labor cost dynamics — and not just at the bottom end of the wage scale — is one of many requirements of running a successful business. Your financial advisor can assist you in analyzing the all the major pieces of your profitability puzzle.

State Minimum Wage Rates for 2022 for Non-Tipped Employees